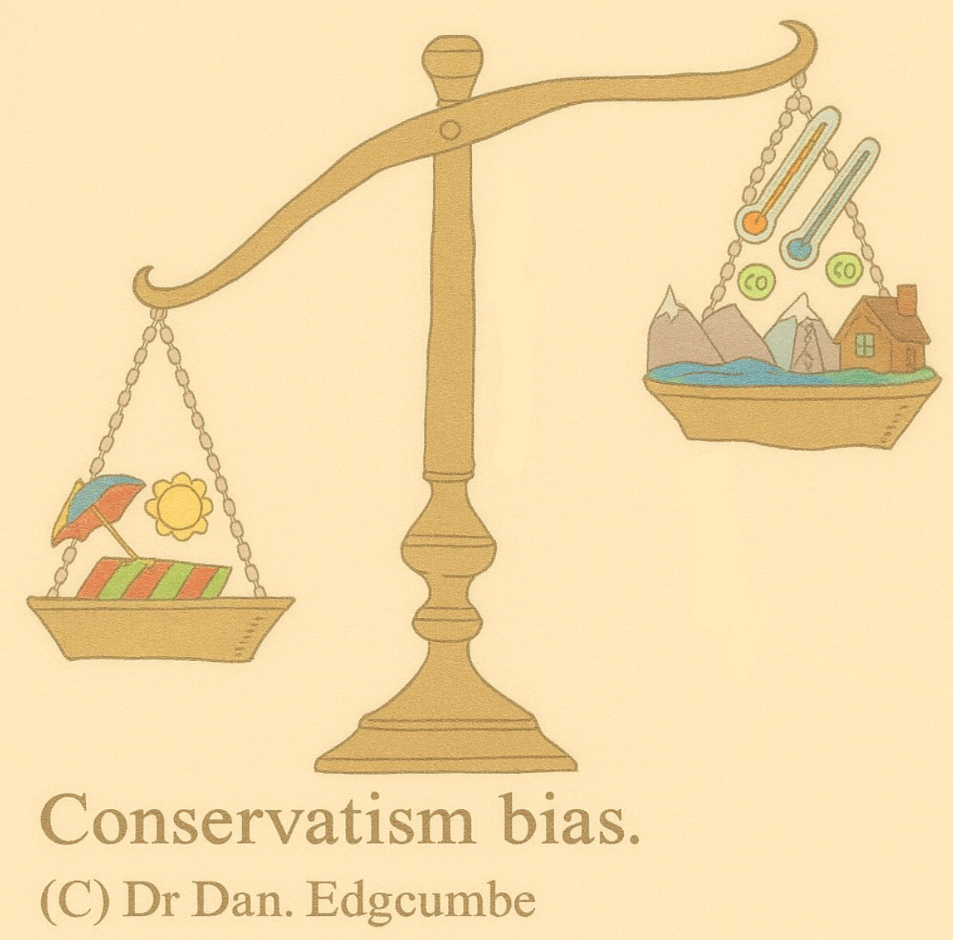

Conservatism Bias (Why do we persist in existing beliefs when presented with new evidence?)

The Conservatism Bias, a brief explanation

What is the Conservatism Bias?

The conservatism bias is the tendency to revise one’s belief insufficiently when presented with new evidence. In doing so we over-weigh the importance one’s belief (the base-rate) and under-weigh the new evidence.

Examples

In finance, investors often under-react to new information (evidence) that contradicts with their beliefs e.g., announcement earnings change in dividends.

An interview panel may rely too heavily on a candidate’s past experiences and credentials whilst being reluctant to consider a more diverse range of candidates e.g., with different backgrounds and related but different credentials.

The literature

Luo, G. Y. (2012). The psychological explanation of asset price overreaction and underreaction to new information: representativeness heuristic and conservatism bias. Journal of Accounting and Finance, 12(2), 38-50.

Wu, C.-H., Wu, C.-S. & Liu, V. W. (2009). The conservatism bias in an emerging stock market: evidence from Taiwan. Pacific-Basin Finance Journal, 17(4), 494-505. Doi: 10.1016/j.pacfin.2008.12.002